What Is Debt-to-Equity Ratio D E?: Definition and Formula

These assets include cash and cash equivalents, marketable securities, and net accounts receivable. The cash ratio provides an estimate of the ability of a company to pay off its short-term debt. Using the D/E ratio to assess a company’s financial leverage may not be accurate if the company expansion and contraction of demand are referred to as the has an aggressive growth strategy. Tesla had total liabilities of $30,548,000 and total shareholders’ equity of $30,189,000. This calculation gives you the proportion of how much debt the company is using to finance its business operations compared to how much equity is being used.

What is considered a good debt-to-equity ratio?

The interest paid on debt also is typically tax-deductible for the company, while equity capital is not. Gearing ratios constitute a broad category of financial ratios, of which the D/E ratio is the best known. For example, a prospective mortgage borrower is more likely to be able to continue making payments during a period of extended unemployment if they have more assets than debt.

- For example, utility companies might be required to use leverage to purchase costly assets to maintain business operations.

- Another example is Wayflyer, an Irish-based fintech, which was financed with $300 million by J.P.

- Banks carry higher amounts of debt because they own substantial fixed assets in the form of branch networks.

- However, since the risks are low, the ratio can be misleading as banks operate with a high level of financial leverage.

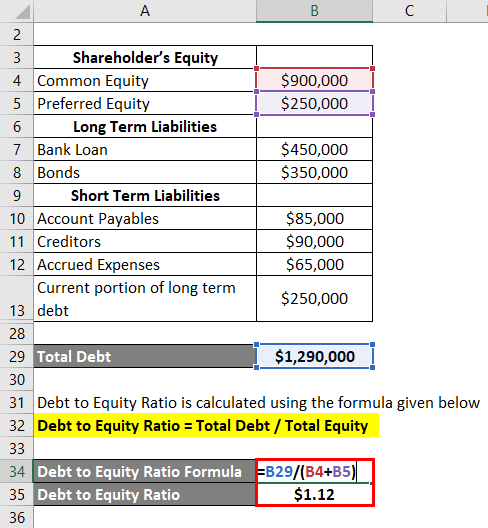

How to Calculate the Debt-to-Equity Ratio

A significantly low ratio may, however, also be found in companies that reluctant to take the advantage of debt financing for growth. Debt to equity ratio (also termed as debt equity ratio) is a long term solvency ratio that indicates the soundness of long-term financial policies of a company. It shows the relation between the portion of assets financed by creditors and the portion of assets financed by stockholders.

Part 2: Your Current Nest Egg

The debt-to-equity (D/E) ratio is used to evaluate a company’s financial leverage and is calculated by dividing a company’s total liabilities by its shareholder equity. It is a measure of the degree to which a company is financing its operations with debt rather than its own resources. Debt typically has a lower cost of capital compared to equity, mainly because of its seniority in the case of liquidation.

Role of Debt-to-Equity Ratio in Company Profitability

It is widely considered one of the most important corporate valuation metrics because it highlights a company’s dependence on borrowed funds and its ability to meet those financial obligations. The debt-to-equity (D/E) ratio can help investors identify highly leveraged companies that may pose risks during business downturns. Investors can compare a company’s D/E ratio with the average for its industry and those of competitors to gain a sense of a company’s reliance on debt. Including preferred stock in total debt will increase the D/E ratio and make a company look riskier. Including preferred stock in the equity portion of the D/E ratio will increase the denominator and lower the ratio.

Everything You Need To Master Financial Modeling

Here’s what you need to know about the debt-to-equity ratio and what it reveals about a company’s capital structure to make better investing decisions. In nutrition science, there’s a theory of metabolic typing that determines what type of macronutrient – protein, fat, carbs or a mix – you run best on. The debt-to-equity ratio is the metabolic typing equivalent for businesses. It can tell you what type of funding – debt or equity – a business primarily runs on. Other industries that tend to have large capital project investments also tend to be characterized by higher D/E ratios. For purposes of simplicity, the liabilities on our balance sheet are only short-term and long-term debt.

If the company were to use equity financing, it would need to sell 100 shares of stock at $10 each. Therefore, comparing D/E ratios across different industries should be done with caution, as what is normal in one sector may not be in another. For instance, utility companies often exhibit high D/E ratios due to their capital-intensive nature and steady income streams.

“Once bond principal and interest payments are made, the leftover profits are retained by shareholders and can be paid out in the form of dividends or buybacks,” Fiorica says. “Therefore, a lower debt-to-equity ratio implies that equity holders have a greater chance of benefiting from growth in retained earnings over time and a lower risk of default.” If preferred stock appears on the debt side of the equation, a company’s debt-to-equity ratio may look riskier.